Halifax Real Estate Market Statistics: October 2025 Market Report

Halifax Real Estate Market Statistics: October 2025 Market Report

Executive Summary

The Halifax-Dartmouth real estate market demonstrated continued resilience in October 2025, with the average home price reaching $612,443 and strong price stability maintained throughout the autumn market. While the market technically remains in seller's territory with an 80.5% sales-to-new-listings ratio, subtle shifts are emerging: homes are spending more time on market (43.8 days) and the sold-to-ask ratio has moderated to 98.5%, indicating buyers are gaining slightly more negotiating room compared to the highly competitive summer months. This comprehensive market report provides the latest statistics, trends, and insights for buyers, sellers, and investors navigating Halifax's evolving housing landscape.

Key October 2025 Market Statistics

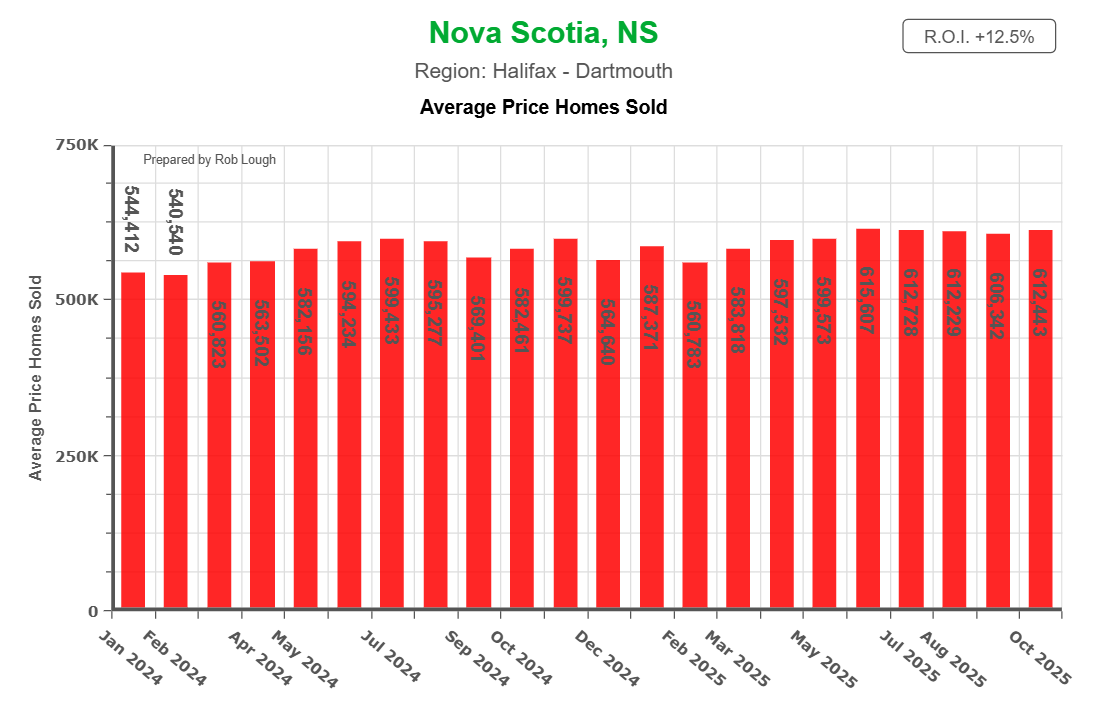

Average Home Prices

October 2025 saw continued price strength across the Halifax-Dartmouth residential real estate market:

- Average Selling Price: $612,443 in October 2025

- Monthly Stability: Virtually unchanged from September 2025 ($606,342)

- Year-over-Year Growth: Up over 12% compared to January 2024 ($544,412)

- Price Resilience: Strong price stability maintained even as market activity shows seasonal slowdown

The average home price in Halifax-Dartmouth has shown remarkable consistency throughout 2025, with prices stabilizing at higher levels after several years of rapid appreciation. The minimal month-over-month change between September and October demonstrates market maturation and more sustainable growth patterns compared to the dramatic increases seen in previous years.

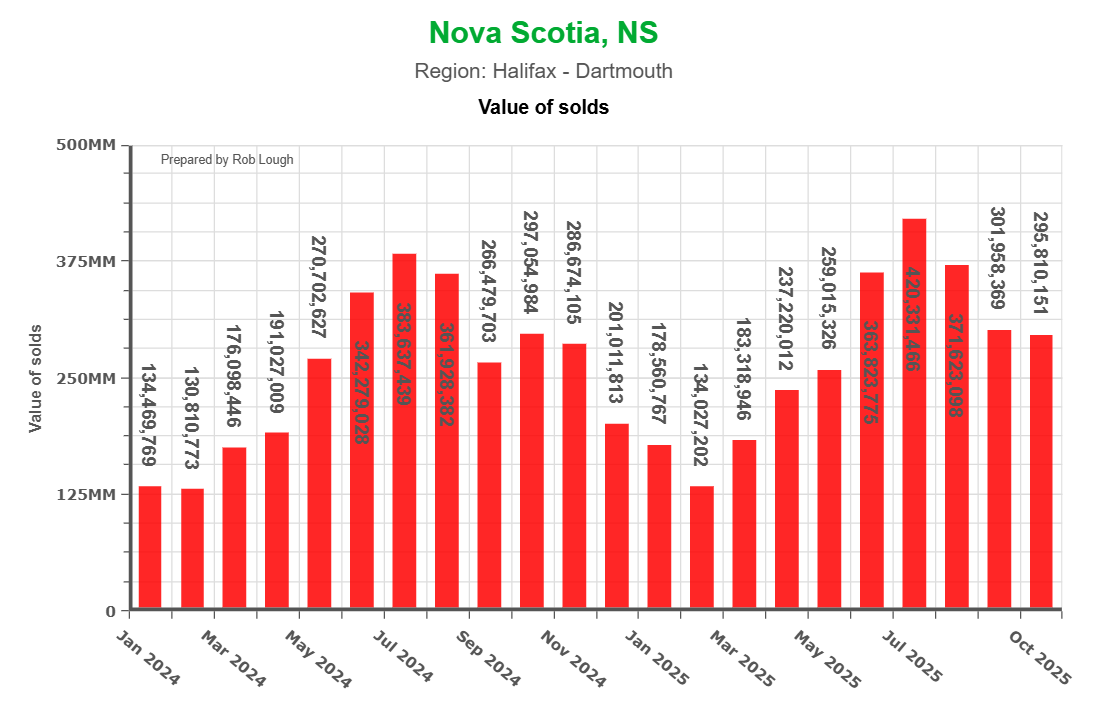

Total Market Value

The aggregate value of transactions reflects sustained buyer demand:

- October Transaction Value: $295.8 million in total sales

- Monthly Comparison: Slight decrease from September 2025 ($301.96 million)

- Seasonal Context: Below summer peak of $420.3 million in July 2025

- Market Interpretation: Sustained activity despite typical autumn slowdown

Market Conditions and Inventory

October 2025 revealed evolving market dynamics as the season transitioned:

- Sales-to-New-Listings Ratio: 80.5% (up sharply from previous months)

- Market Type: Transitioned back to a seller's market

- Active Inventory: Approximately 920 homes for sale

- Inventory Change: 3% decrease year-over-year

- New Listings: 415 new properties hit the market (consistent with 2024)

- Seasonal Pattern: Typical October shift toward seller-favorable conditions

The elevated sales-to-new-listings ratio reflects typical seasonal patterns for October in the Halifax market. However, the simultaneous increase in days on market (43.8 days) and slight moderation in sold-to-ask ratios (98.5%) suggests a more nuanced picture: while seller's market conditions technically persist due to limited inventory, buyers are exercising more selectivity and patience compared to the highly competitive summer months.

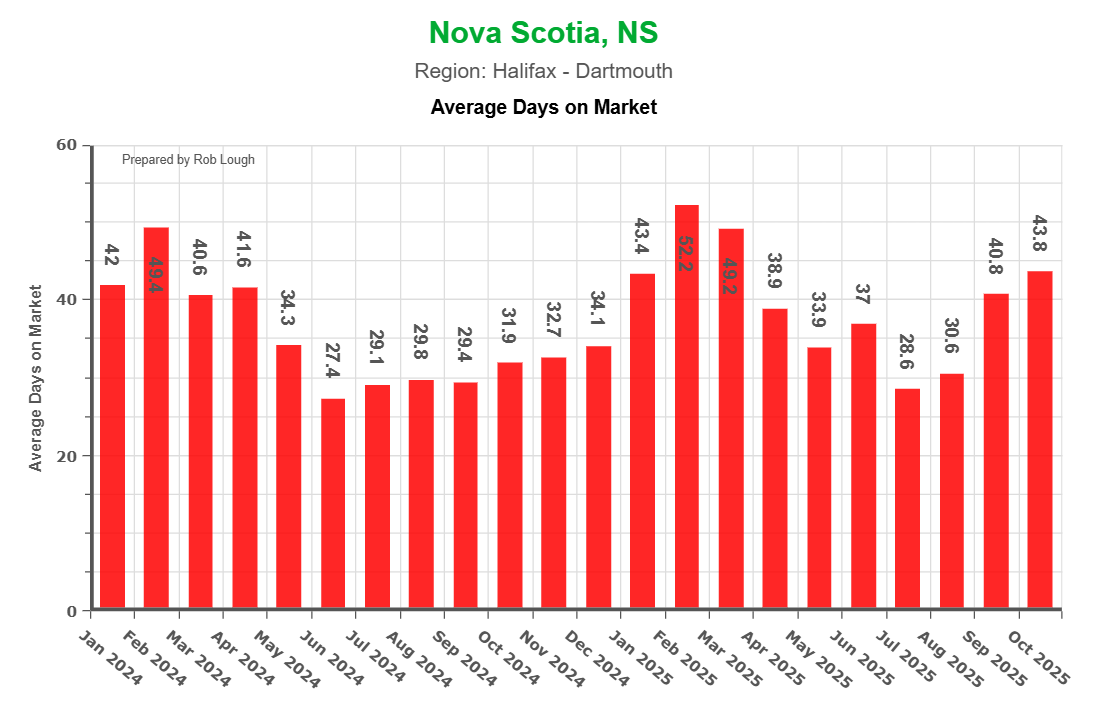

Days on Market

Properties took longer to sell compared to summer months:

- Average Days on Market: 43.8 days in October 2025

- Monthly Comparison: Up from 40.8 days in September 2025

- Summer Market: Sharp increase from peak efficiency of under 31 days in July/August

- Market Velocity: Slowdown reflects typical autumn seasonality and increased buyer selectivity

This increase in days on market represents a notable shift from the exceptionally fast-paced summer market. The trend suggests buyers are taking more time to evaluate properties, conducting more thorough due diligence, and potentially waiting for more favorable pricing or selection. This is consistent with typical seasonal patterns as the market transitions from peak summer activity toward the traditionally slower winter months.

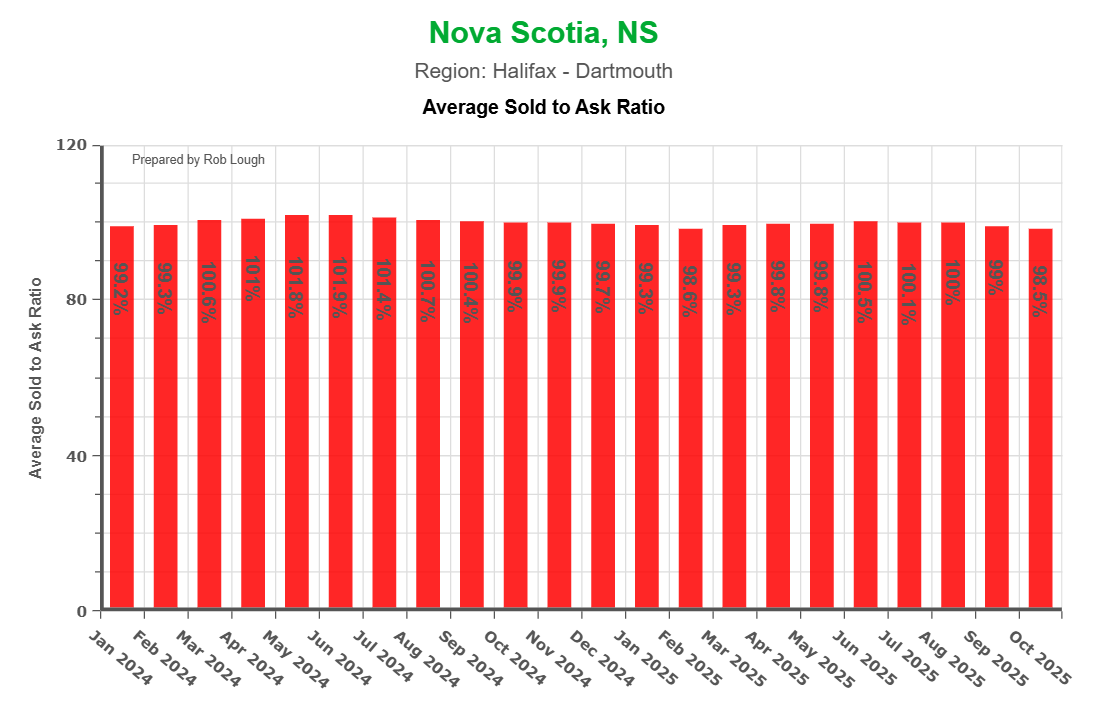

Sold-to-Ask Price Ratio

Sellers continued to achieve strong prices relative to their asking prices:

- October Ratio: 98.5% average sold-to-ask ratio

- Monthly Trend: Marginal decrease from September's 99%

- Summer Peak: Ratios exceeded 100% during July/August competitive period

- Market Interpretation: Sellers achieving near-asking prices with slightly more negotiation room

The high sold-to-ask ratio demonstrates that the Halifax-Dartmouth market remains competitive and favorable for sellers. While the slight decline from peak summer levels suggests buyers have marginally more negotiating power than during the height of the market, properties are still selling for very close to their list price. This indicates that well-priced homes continue to attract strong offers, though buyers may be securing small concessions or price adjustments more frequently than in previous months.

Months of Supply

The months of supply metric remained in seller's market territory:

- Current Months of Supply: 2.2 months

- Historical Range: Hovering between 2.0-2.5 months throughout 2025

- Market Balance: A balanced market typically shows 4-6 months of supply

With months of supply well below the balanced threshold, sellers continue to hold negotiating leverage in most price segments.

Property Type Breakdown: October 2025 Performance

October 2025 revealed remarkable variation in performance across different property types, with some segments achieving record highs and extraordinary year-over-year returns. The following analysis examines each property category based on Halifax-Dartmouth market data.

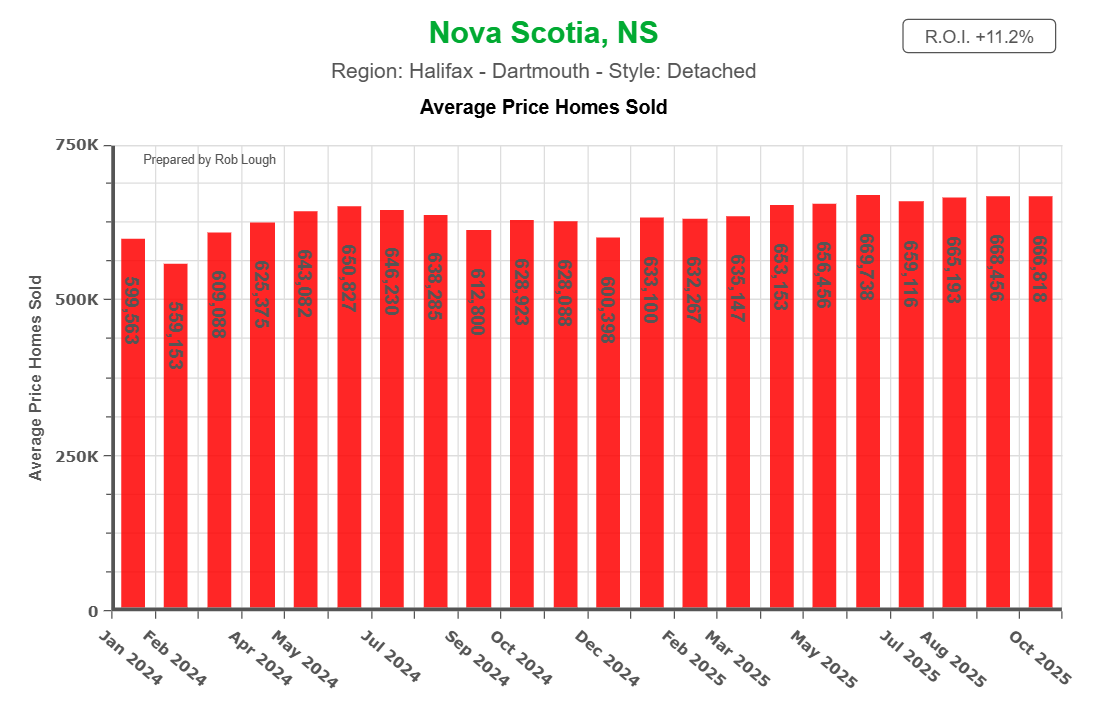

Detached Homes

Single-family detached homes reached new price peaks in October 2025:

- Average Price: $669,818 in October 2025

- Market Position: Highest price point in the last 22 months

- Year-over-Year ROI: +11.2%

- Monthly Trend: Accelerating momentum since June 2025

- Market Characteristics: Steady appreciation reflecting sustained desirability

Detached homes continue to command premium prices in the Halifax-Dartmouth market, attracting families and move-up buyers seeking established neighborhoods, yards, and traditional single-family living. While the 11.2% year-over-year return is the most modest among all property types, it represents solid appreciation for the market's highest-priced segment. The acceleration in price momentum since June suggests strong demand has persisted through what is typically a slower autumn period.

The detached home segment appeals primarily to families with children, professionals seeking home offices, and buyers prioritizing privacy and outdoor space. Inventory in this category remains limited, particularly in sought-after neighborhoods like the South End, Clayton Park, and Bedford.

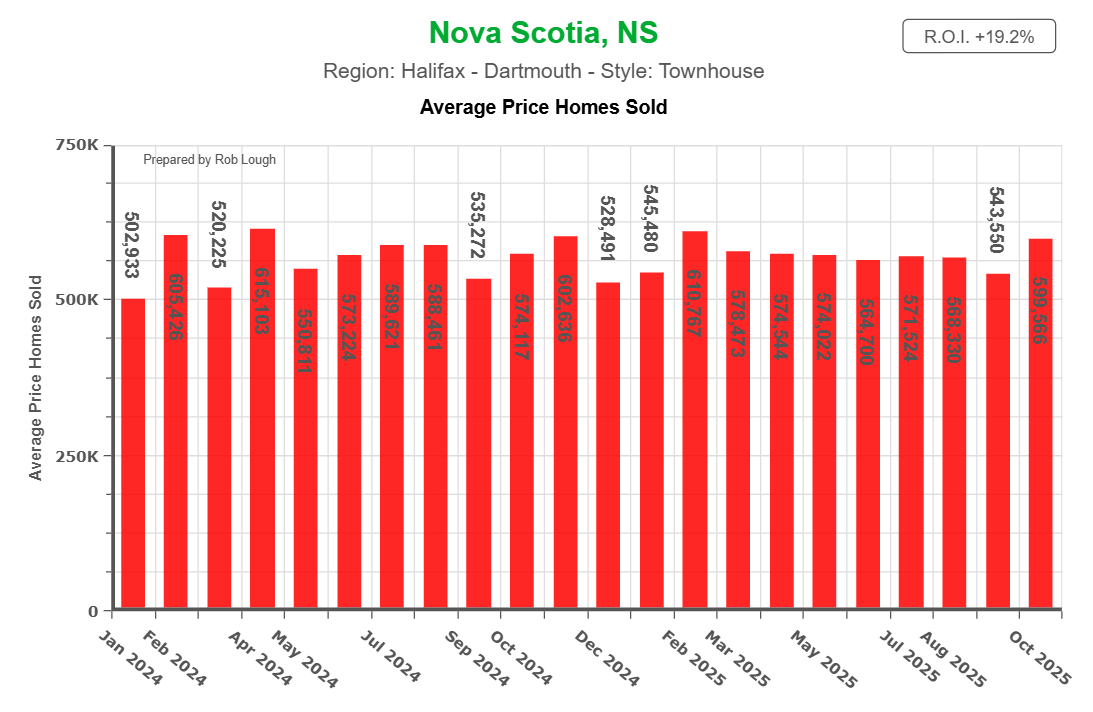

Townhouses

Townhouses demonstrated robust performance throughout 2025:

- Average Price: $599,566 in October 2025

- Year-over-Year ROI: +19.2%

- Annual Price Range: From $502,933 in January to near $600,000 in October

- Market Appeal: Strong middle-ground option between condos and detached homes

- Buyer Profile: Young families, first-time move-up buyers, downsizers

Townhouses have emerged as one of the star performers in the Halifax-Dartmouth market, posting impressive 19.2% year-over-year appreciation. The nearly $97,000 increase in average price from January ($502,933) to October ($599,566) reflects intense demand for this property type, which offers more space than condos while remaining more affordable than detached homes.

This segment has benefited from several market dynamics: first-time buyers priced out of detached homes, empty-nesters seeking low-maintenance living with more space than apartments, and investors attracted to rental potential. The townhouse market has seen particularly strong activity in suburban areas like Dartmouth, Bedford, and Sackville, where newer developments offer modern amenities and proximity to urban centers.

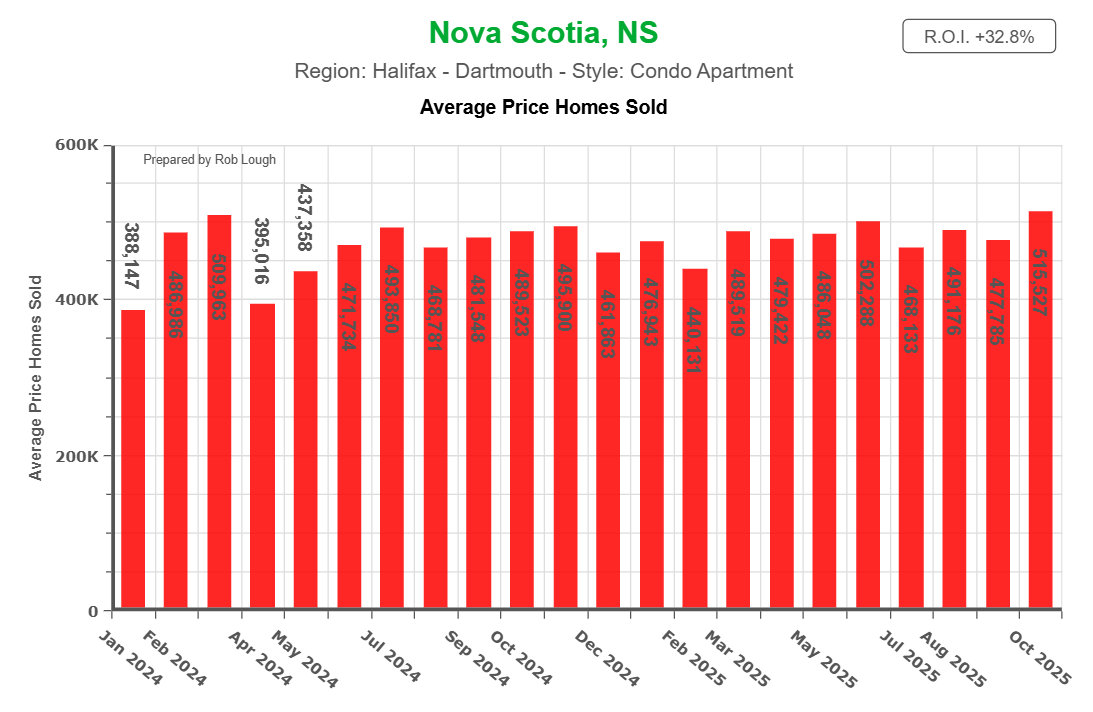

Condo Apartments

Condominiums delivered the most spectacular returns in October 2025:

- Average Price: $515,527 in October 2025 (new high for the period)

- Year-over-Year ROI: +32.8% (highest among all property types)

- Market Momentum: October surge reversed recent monthly dips

- Supply Dynamics: Strong demand meeting limited new supply

- Market Position: Breakthrough performance indicating fundamental shift

The condo apartment segment's extraordinary 32.8% year-over-year return stands as the most remarkable story in Halifax-Dartmouth's October 2025 market. This dramatic appreciation reflects several converging factors:

Supply Constraints: Limited new condo construction over the past several years has created scarcity, particularly for well-located units near downtown Halifax, Dartmouth waterfront, and transit corridors.

Demographic Demand: Strong interest from first-time buyers seeking affordable entry points, young professionals prioritizing walkability and amenities, downsizing baby boomers, and investors attracted to rental income potential.

Affordability Migration: As detached homes exceed $669,000 and townhouses approach $600,000, condos under $520,000 represent the most accessible homeownership opportunity for many buyers.

Urban Living Preferences: Growing appreciation for downtown living, reduced commuting, and amenity-rich buildings has strengthened condo appeal, particularly post-pandemic as urban centers have revitalized.

The October surge to $515,527 represents a new high and suggests the condo market remains undersupplied relative to demand, despite recent monthly fluctuations earlier in the year.

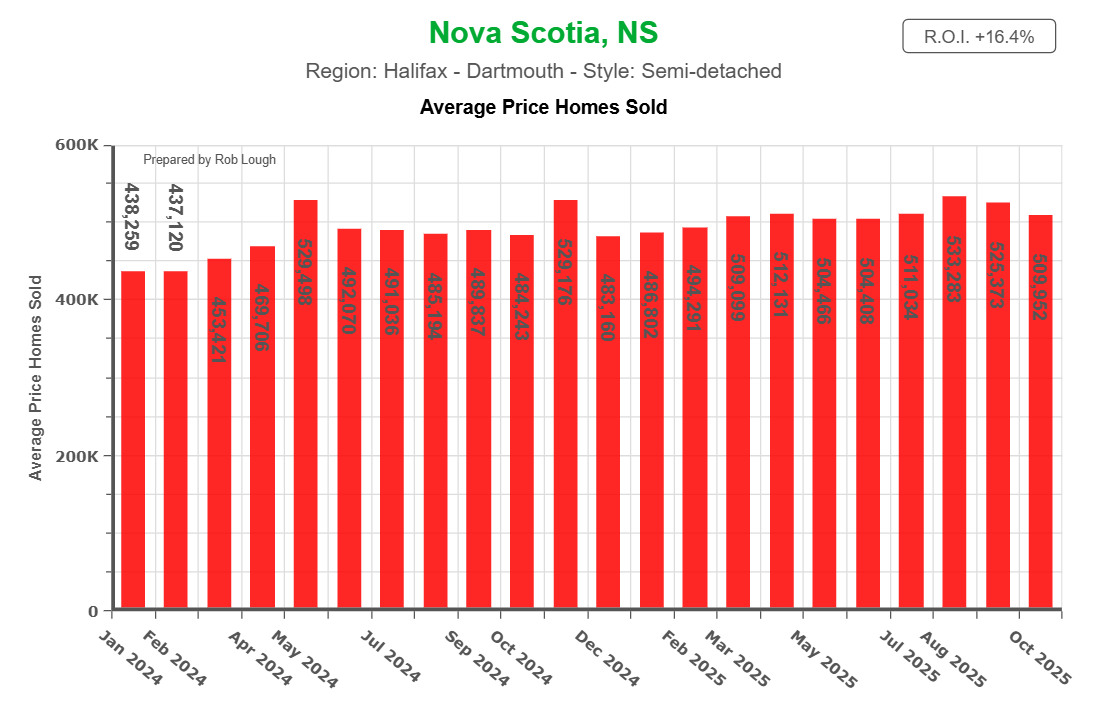

Semi-Detached Homes

Semi-detached properties showed strong appreciation with some recent moderation:

- Average Price: $509,952 in October 2025

- Year-over-Year ROI: +16.4%

- Recent High: $533,283 in August 2025

- Market Positioning: Affordable alternative to detached homes

- Performance: Strong gains throughout 2024 and into 2025

Semi-detached homes, offering some characteristics of single-family living at lower price points than fully detached properties, have posted solid 16.4% year-over-year appreciation. While October's price of $509,952 represents a modest decline from the August peak of $533,283, the segment remains well above early 2024 levels and continues to attract buyers seeking value.

This property type appeals to a diverse buyer pool: first-time buyers wanting more space than condos or townhouses, families needing yards and multiple bedrooms at accessible prices, and investors seeking rental properties with strong cash flow potential.

The slight October decline from August highs may reflect seasonal factors rather than fundamental weakness, as this pattern has appeared across multiple property types as the market transitions from peak summer activity.

Property Type Comparative Analysis

October 2025 Performance Summary

| Property Type | Oct 2025 Avg Price | Year-over-Year ROI | Market Position |

|---|---|---|---|

| Condo Apartment | $515,527 | +32.8% | Highest ROI, new price high |

| Townhouse | $599,566 | +19.2% | Near annual high, strong momentum |

| Semi-Detached | $509,952 | +16.4% | Solid gains, slight retreat from August |

| Detached | $669,818 | +11.2% | Record high, steady appreciation |

Key Investment and Market Insights

Price Range Considerations: The property types now cluster in a relatively narrow absolute dollar range, with only $160,000 separating condos ($515,527) from detached homes ($669,818). This compression suggests:

- Condos offering exceptional value relative to other types

- Detached home premium shrinking as condo prices surge

- Townhouses positioned in the market's sweet spot at $599,566

- Semi-detached homes providing best balance of space and affordability

ROI Performance: The dramatic variation in year-over-year returns—from 11.2% for detached homes to 32.8% for condos—reveals significant market segmentation:

- Condo apartments (+32.8%): Extraordinary returns reflecting supply-demand imbalance

- Townhouses (+19.2%): Strong appreciation as preferred middle option

- Semi-detached (+16.4%): Robust gains demonstrating sustained demand

- Detached homes (+11.2%): Modest but solid returns for premium segment

Affordability Implications: The rapid appreciation in "affordable" segments (condos, townhouses, semi-detached) outpacing detached homes suggests:

- First-time buyers concentrating in lower-priced segments

- Supply constraints most acute in condo and townhouse markets

- Detached home market showing signs of price resistance above $670,000

- Market bifurcation between accessible and premium segments

Investment Opportunities: Based on October 2025 performance:

Condos: Highest returns but potentially near-term correction risk after 32.8% surge; strong rental income potential with 2.1% vacancy rate

Townhouses: Balanced appreciation and demand; excellent for rental properties; new developments offering modern amenities

Semi-Detached: Solid returns with lower entry price than detached; appealing cash flow for investors; family-friendly option

Detached: Most stable appreciation; appeals to move-up buyers with substantial equity; slower velocity but quality buyer pool

Market Timing by Property Type

Best Current Opportunities:

- Condos: High prices but sustained demand suggests continued strength; watch for inventory increases

- Townhouses: Strong fundamentals with balanced pricing; competitive but not overheated

- Semi-Detached: Modest October pullback from August may present entry opportunity

- Detached: Premium market with longer marketing times above $750,000; negotiation possible

Segments to Monitor:

- Condo supply pipeline: New construction could moderate extraordinary price growth

- Townhouse developments: Several projects planned for 2026 delivery

- Detached home inventory: Limited supply supporting prices despite slower ROI

- Semi-detached availability: Historically limited stock in this category

Understanding Market-Wide Average Price

The overall Halifax-Dartmouth average home price of $612,443 in October 2025 represents a weighted average across all property types based on transaction volume in each segment. This figure falls between the condo apartment average ($515,527) and detached home average ($669,818), reflecting the market's mix of sales. Changes in the proportion of property types sold can influence the overall average even when individual segment prices remain stable.

For buyers and sellers, understanding both the overall market average and specific property type averages is crucial for accurate pricing, negotiations, and investment decisions. A buyer targeting townhouses, for instance, should focus on the $599,566 benchmark rather than the overall $612,443 average, while sellers of detached homes need to consider their segment's $669,818 average and slower velocity at premium price points.

October 2025 Market Trends Analysis

Seasonal Shift in Market Dynamics

October 2025 marked a transitional period in the Halifax-Dartmouth real estate market, characterized by several notable trends:

From Peak Summer to Autumn Balance: The market experienced a natural cooling from its July 2025 peak, when total transaction values reached $420.3 million. October's $295.8 million in sales represents a 30% decrease from that summer high, though it remains substantially above levels seen in early 2024 and 2025.

Increased Buyer Deliberation: The rise in average days on market from under 31 days in July/August to 43.8 days in October signals a fundamental shift in buyer behavior. This extended timeline suggests:

- Buyers conducting more thorough property evaluations

- Less fear-driven urgency compared to peak market conditions

- Increased inventory providing more options for selection

- Greater price consciousness and negotiation

Price Resilience Despite Volume Softening: Perhaps most significantly, average home prices remained virtually flat between September ($606,342) and October ($612,443), demonstrating remarkable stability. This price resilience in the face of:

- Longer days on market

- Lower transaction volumes

- Seasonal market softening

...indicates that seller expectations and buyer willingness to pay remain aligned at current price levels.

Negotiation Dynamics Shifting: The sold-to-ask ratio declining from 99% in September to 98.5% in October, and down from over 100% during summer months, represents a subtle but meaningful shift. While sellers are still achieving excellent prices relative to their asking amounts, buyers are:

- Successfully negotiating minor price reductions more frequently

- Securing seller concessions on repairs or closing costs

- Finding less competition on moderately priced properties

- Able to include conditions in offers more readily

Market Balance Indicators

October's metrics collectively paint a picture of a market seeking new equilibrium:

Still Seller-Favorable, But Moderating: With an 80.5% sales-to-new-listings ratio, the market technically remains in seller's territory (typically 60% or above). However, the simultaneous increase in days on market suggests this ratio may not capture the full story of changing dynamics.

Inventory Stability: The relatively unchanged inventory levels (920 homes for sale, down only 3% year-over-year) combined with consistent new listing volumes (415 properties) indicates supply has plateaued rather than continuing to tighten.

Volume-Price Disconnect: The most interesting October trend is the disconnect between transaction volume and pricing. While fewer properties sold compared to summer months, prices held firm, suggesting:

- Motivated buyers still willing to pay current prices

- Sellers unwilling to reduce prices significantly

- Quality properties still attracting competitive interest

- Market participants expecting price stability or modest growth

Year-to-Date Performance (January-October 2025)

Cumulative Statistics

Halifax's real estate market has shown resilience through the first ten months of 2025:

- Average Sale Price (YTD): $602,163 across all property types

- Year-over-Year Growth: 3.9% increase from 2024's average of $579,400

- Total Sales Volume: 3,194 transactions (2.4% increase from 2024)

- Total Listings: 4,623 properties (10.4% increase from 2024)

The increased inventory has helped moderate price growth while still maintaining a seller-favorable environment.

Economic Context

Halifax Economic Indicators

Halifax's real estate market benefits from strong underlying economic fundamentals:

- GDP Growth: Halifax's real GDP grew 3.9% in 2024 (outpacing national and provincial averages)

- Future Projections: Expected 1.3% growth in 2025, averaging 1.7% annually through 2029

- Regional Impact: Halifax accounted for 82.4% of Nova Scotia's net real GDP growth in 2024

- Unemployment Rate: 6.1% in September 2025 (down from 6.4% in August)

Inflation and Interest Rate Environment

Economic conditions continue to influence affordability:

- Halifax Inflation Rate: 2.8% annualized (September 2025)

- Interest Rate Outlook: Anticipation of potential rate cuts in 2026

- Mortgage Market: Buyers increasingly confident as rate stability improves

- Affordability Challenges: Rising home prices outpacing wage growth for some segments

Rental Market Overview

Halifax's rental market remains tight with strong demand:

- Average Monthly Rent: $1,636 across all apartment types (2024 data)

- Year-over-Year Rent Growth: 6.4% increase from 2023

- Vacancy Rate: 2.1% in 2024 (up from historic low of 1.0%)

- Fastest Growing Segment: 3+ bedroom units saw 7.9% rent increases

The rental market's strength reflects Halifax's growing population and appeal to new residents and immigrants.

Emerging Neighborhoods and Investment Opportunities

High-Growth Areas

Several communities are experiencing increased buyer interest:

Bedford: Combining accessibility to Halifax with family-friendly amenities and relatively more affordable housing options.

East Hants: Rising popularity due to lower entry prices and improving infrastructure connections to the urban core.

Suburban Halifax: Bayers Lake and surrounding areas continue attracting buyers seeking value.

Infrastructure Developments

Major projects supporting market growth include:

- Barrington Street Transit Terminal: Completed in Summer 2025, improving downtown connectivity

- Bus Rapid Transit: Planned expansion across the peninsula

- Windsor Street Exchange: Multi-year highway redesign improving Bedford Highway access

- Housing Accelerator Fund: Targeting 2,600 new homes within three years

Market Outlook and Predictions

Short-Term Forecast (Q4 2025)

The remainder of 2025 is expected to see:

- Price Appreciation: Continued moderate growth of 2% through year-end

- Sales Activity: Anticipated 2% increase in transaction volume

- Seasonal Patterns: Traditional fall market activity before winter slowdown

- Inventory Levels: Gradual increase as new developments come online

Long-Term Trends (2026 and Beyond)

Looking ahead, several factors will shape Halifax's market:

Population Growth: Continued immigration and interprovincial migration supporting demand

Affordability Pressures: Rising prices creating challenges for first-time buyers and lower-income households

Supply Response: Government initiatives and zoning reforms aimed at increasing housing supply

Economic Factors: Potential interest rate cuts could stimulate renewed buyer activity

Market Maturation: Transition from rapid appreciation to more sustainable growth rates

What This Means for Buyers

First-Time Homebuyers

October 2025 presents a more balanced opportunity landscape compared to the frenetic summer market:

Improved Conditions:

- More time to evaluate properties (43.8 days average on market)

- Slightly more negotiating room (98.5% sold-to-ask ratio)

- Less panic-driven competition than peak summer months

- Realistic chance to include conditions in offers

Property Type Considerations for First-Time Buyers:

- Condo Apartments ($515,527 average): Most accessible entry point, but 32.8% year-over-year appreciation has reduced affordability advantage

- Semi-Detached Homes ($509,952 average): Comparable pricing to condos with more space; 16.4% ROI demonstrates solid value

- Townhouses ($599,566 average): Premium over condos but 19.2% appreciation shows strong demand; excellent middle-ground option

- Detached Homes ($669,818 average): Generally out of reach for most first-time buyers without substantial down payments or dual incomes

Continuing Challenges:

- Even "affordable" segments like condos have appreciated dramatically (+32.8% YOY)

- Seller's market conditions still favor those listing properties

- Down payment requirements substantial across all property types

- Pre-approval remains essential for credibility

- Well-priced properties still attract multiple offers, especially under $550,000

Strategic Approaches:

- Focus search on condos and semi-detached homes for best entry pricing

- Consider emerging neighborhoods where townhouses may still be under $550,000

- Act decisively on well-priced properties, but don't rush into overpriced listings

- Use the longer market times (43.8 days) to conduct thorough inspections and due diligence

- Leverage government programs: First-Time Home Buyer Incentive, Home Buyers' Plan (RRSP withdrawal)

- Work with experienced local real estate professionals who understand property type dynamics

- Get pre-approved for mortgage to understand realistic budget by property type

- Factor in all costs: property taxes, condo fees, utilities, insurance, maintenance

Move-Up Buyers

Established homeowners face nuanced considerations in October 2025:

Advantages:

- Significant equity gains from previous purchases (12%+ appreciation since January 2024)

- More selection and less urgency compared to summer

- Properties above $750,000 seeing slower activity, providing opportunities

- Ability to be more selective given market moderation

Challenges:

- Timing the sale of existing property with new purchase remains complex

- Higher mortgage rates than previous renewals

- Need to price competitively if selling simultaneously

- Market showing signs of seasonal slowdown into winter

Timing Considerations:

- October through December traditionally slower, may favor buyers

- Spring 2026 could see renewed activity and competition

- Interest rate outlook uncertain but potential cuts on horizon

What This Means for Sellers

Optimal Timing and Market Realities

October 2025 conditions remain favorable for sellers, but with important caveats:

Strengths:

- Seller's market dynamics with limited inventory (920 homes)

- Strong price stability at $612,443 average

- Continued buyer demand across most price points

- 98.5% sold-to-ask ratio demonstrates pricing power

Emerging Challenges:

- Properties taking longer to sell (43.8 days vs. 31 days in summer)

- Seasonal slowdown heading into winter months

- Buyers exercising more selectivity and patience

- Slight moderation in sold-to-ask ratio from summer peak

Pricing Strategy for Current Market

The October data reveals crucial pricing insights:

Realistic Pricing Critical: With homes spending 43.8 days on market, overpricing risks extended listing periods. Properties priced competitively are still achieving 98.5% of asking price, but those priced aggressively may languish.

Market Price is Achievable: The high sold-to-ask ratio demonstrates that well-priced properties still command strong offers. Sellers should:

- Price at or slightly below market comparables to attract offers

- Avoid testing the market with inflated pricing

- Be prepared for modest negotiation (1-2% off asking)

- Consider that buyers are conducting more thorough comparisons

Seasonal Considerations:

- October-December traditionally slower than spring/summer

- Properties listed now may carry into New Year

- Spring 2026 could bring renewed buyer activity

- Consider whether to list now or wait for spring market

Preparation and Presentation

To maximize results in the current market:

Pre-Listing Essentials:

- Professional home inspection to identify and address issues proactively

- Strategic improvements focusing on high-ROI updates (kitchen, bathrooms, curb appeal)

- Deep cleaning and decluttering to show at its best

- Professional staging to help buyers envision the space

Marketing Excellence:

- High-quality photography capturing property's best features

- Virtual tours and video walkthroughs for remote buyers

- Comprehensive online presence across all platforms

- Targeted marketing to reach motivated buyer segments

Showing Flexibility:

- Accommodate showing requests promptly

- Extended showing hours including evenings and weekends

- Virtual showing options for out-of-town buyers

- Property available on short notice for serious buyers

Professional Representation:

- Work with agents demonstrating recent sales in current market

- Choose professionals with strong negotiation skills

- Ensure marketing plan addresses longer days-on-market reality

- Regular communication and strategy adjustments as needed

Price Point Considerations

October data suggests different dynamics by price segment:

Under $500,000: Highest demand, multiple offers still common, quick sales likely

$500,000-$750,000: Solid activity, competitive pricing essential, expect 30-45 days

Above $750,000: Slower market, premium properties require patience and aggressive marketing

Luxury Market ($1M+): Extended timelines expected, focus on unique features and quality presentation

Investment Opportunities

Residential Investment by Property Type

Halifax-Dartmouth offers several investment avenues with varying return profiles based on October 2025 data:

Condo Apartments - Highest Appreciation Potential:

- ROI: Extraordinary 32.8% year-over-year return

- Average Price: $515,527 (lowest entry cost)

- Rental Demand: Strong with 2.1% vacancy rate

- Cash Flow: Solid rental income potential, though condo fees reduce net returns

- Risk Factors: Rapid appreciation may indicate near-term correction risk; supply increases could moderate growth

- Best For: Investors seeking capital appreciation; those targeting student, young professional, or downtown rental markets

Townhouses - Balanced Growth Investment:

- ROI: Robust 19.2% year-over-year return

- Average Price: $599,566 (mid-market positioning)

- Rental Appeal: Families, professionals seeking space, small households

- Cash Flow: Excellent rental yields with lower condo fees than apartments

- Market Stability: Strong fundamentals without overheating concerns

- Best For: Long-term investors seeking balance of appreciation and income; family rental market

Semi-Detached - Value Play:

- ROI: Solid 16.4% year-over-year return

- Average Price: $509,952 (comparable to condos with more space)

- Rental Market: Strong demand from families, multi-generational households

- Cash Flow: Higher than detached homes; no condo fees

- Recent Trend: Slight October pullback from August peak may present entry opportunity

- Best For: Investors seeking single-family rental characteristics at accessible price point

Detached Homes - Premium Stability:

- ROI: Steady 11.2% year-over-year return

- Average Price: $669,818 (highest entry cost)

- Rental Demand: Executive relocations, larger families, premium market

- Cash Flow: Lower yields due to higher acquisition cost

- Market Position: Record high prices with sustained demand

- Best For: Established investors with substantial capital; long-term appreciation focus; premium rental market

Investment Strategy by Budget

Under $550,000: Focus on condo apartments and semi-detached homes

- Highest appreciation potential (32.8% and 16.4% respectively)

- Strong rental demand across both segments

- Most accessible entry points for new investors

$550,000-$650,000: Target townhouses and upper-tier condos

- Balanced appreciation (19.2% for townhouses)

- Excellent rental demographics

- Modern amenities in newer developments

Above $650,000: Detached homes and luxury condos

- Stable appreciation with quality tenant pool

- Premium rental rates

- Lower vacancy risk with executive market

Risk-Return Considerations

High Risk, High Return: Condo apartments with 32.8% ROI offer exceptional gains but face potential correction risk if supply increases significantly. Best for investors with shorter time horizons seeking capital appreciation.

Balanced Risk-Return: Townhouses (19.2% ROI) and semi-detached homes (16.4% ROI) offer strong appreciation with more stable fundamentals. Ideal for most residential investors.

Lower Risk, Moderate Return: Detached homes (11.2% ROI) provide steady appreciation with established buyer pool. Suitable for conservative, long-term investors with substantial capital.

Multi-Family and Commercial Investment

Beyond single-unit residential, commercial markets show promise:

Rental Properties: Strong rental demand with 2.1% vacancy rate supports investment returns

Multi-Family Units: Townhouses and small multi-unit properties showing strong appreciation

Pre-Construction: New developments offer potential appreciation during construction

Renovation Projects: Opportunities in established neighborhoods near downtown

Commercial Real Estate

Beyond residential, commercial markets show promise:

Office Space: Vacancy declining to 10.9% in Q3 2025, down from 11.5% in Q2

Industrial: Average gross rent increasing with strong demand

Retail: Steady performance in strategic locations with growing population

Policy and Regulatory Environment

Recent Policy Changes

Several government initiatives are impacting the market:

Housing Accelerator Fund: Federal-provincial agreement targeting 2,600 new homes by 2026, with 8,866 planned over 10 years

Surplus Land Program: HRM conveying municipal land to non-profits for affordable housing (launched July 2025)

Zoning Reforms: As-of-right zoning changes to expedite development approvals

Rent Control: 5% annual rent increase cap extended through 2027

HST Exemption: Nova Scotia eliminated 10% HST on new purpose-built rental properties (October 2023)

Impact on Market Dynamics

These policies aim to:

- Increase housing supply across all segments

- Improve affordability for renters and buyers

- Accelerate development timelines

- Support purpose-built rental construction

Regional Comparison

Halifax's market performance relative to other Atlantic Canadian cities:

Competitive Advantages:

- Strongest economic growth in Atlantic Canada

- Major employment hub with diverse industries

- Growing population and immigration

- Comprehensive infrastructure and amenities

Price Positioning:

- Higher than Moncton and Saint John

- More affordable than Toronto and Vancouver

- Competitive with similar-sized cities nationally

Affordability Analysis

Housing Affordability Metrics

Current affordability considerations:

Average Income to Price Ratio: Housing costs consuming larger share of household income

Down Payment Requirements: $120,000+ needed for 20% down on average home

Monthly Carrying Costs: Mortgage, taxes, insurance, and utilities averaging $3,500-4,500 for typical home

First-Time Buyer Challenges: Entry-level homes ($400,000-$500,000) increasingly scarce

Affordability Solutions

Various programs and strategies available:

- First-time homebuyer incentives and tax credits

- CMHC-insured mortgages with lower down payments

- Co-ownership and family assistance programs

- Exploring emerging neighborhoods with lower price points

- Considering townhouses and condos over detached homes

Market Risks and Considerations

Potential Headwinds

Factors that could impact market performance:

Economic Uncertainty: Global trade tensions and recession risks

Interest Rate Volatility: Potential for rates to remain elevated longer

Affordability Crisis: Risk of pricing out significant buyer segments

Climate Events: Recent wildfires and flooding raising insurance and location concerns

Overbuilding Risk: Rapid supply increase could pressure prices in some segments

Risk Mitigation

Strategies for navigating uncertainty:

- Conservative financing with stress-test buffers

- Long-term ownership horizon (5+ years)

- Diversified investment approach

- Professional advice from realtors, mortgage brokers, and financial advisors

- Thorough due diligence on properties and neighborhoods

Expert Market Commentary

Real estate professionals observe several key themes in October 2025:

Market Maturation: Halifax transitioning from rapid growth phase to more stable appreciation

Buyer Behavior: Increased sophistication and selectivity among purchasers

Inventory Dynamics: Supply slowly improving but still below balanced market levels

Price Stabilization: Growth rates moderating to sustainable levels

Geographic Expansion: Development spreading to suburban and peripheral communities

Frequently Asked Questions

Is October 2025 a good time to buy in Halifax-Dartmouth?

October 2025 presents improved conditions for buyers compared to the peak summer market. With homes spending an average of 43.8 days on market (up from under 31 days in July/August) and sold-to-ask ratios at 98.5% (down from over 100% in summer), buyers have more time to evaluate properties and slightly better negotiating positions. However, with average prices at $612,443 and seller's market conditions still technically in place, prepared buyers with pre-approvals and realistic expectations will fare best.

How does Halifax compare to other Canadian cities?

Halifax-Dartmouth offers significant relative affordability compared to Toronto and Vancouver while providing strong economic fundamentals (3.9% GDP growth in 2024), quality of life, and continued appreciation potential. The 12%+ year-over-year price growth demonstrates solid investment returns while remaining accessible to a broader range of buyers than Canada's most expensive markets.

What price range sees the most activity?

Properties under $500,000 experience the highest demand and fastest sales, often still attracting multiple offers. The $500,000-$650,000 range sees solid activity with typical marketing periods of 30-45 days. Above $750,000, the market slows considerably, with premium properties requiring more time and strategic marketing.

Are prices expected to continue rising?

October 2025 data shows remarkable price stability month-over-month ($612,443 in October vs. $606,342 in September), suggesting the market has reached a sustainable equilibrium. Moderate appreciation of 2-5% annually is anticipated through 2026, far more sustainable than previous years' rapid increases. The transition from transaction volume of $420.3 million in July to $295.8 million in October, while prices held firm, indicates seller expectations and buyer willingness to pay remain aligned.

What areas offer the best value?

East Hants, Bedford, and suburban communities continue to provide better affordability while maintaining good access to Halifax amenities and employment centers. These areas benefit from infrastructure improvements (Windsor Street Exchange, Bus Rapid Transit expansion) and offer attractive options for families seeking more space at lower price points.

What does the sold-to-ask ratio tell me?

October's 98.5% sold-to-ask ratio means that on average, homes are selling for 98.5% of their listed price. This represents a slight moderation from September's 99% and summer's 100%+ ratios, indicating buyers are successfully negotiating modest price reductions more frequently. However, the ratio remains high by historical standards, demonstrating sellers still command strong pricing power.

Why are homes taking longer to sell?

The increase from under 31 days on market in July/August to 43.8 days in October reflects several factors: seasonal market slowdown (typical autumn pattern), increased buyer selectivity as urgency diminishes, more thorough due diligence and property evaluations, and slightly improved inventory providing more options. This is a healthy market correction from the frenetic summer pace.

Should I wait for interest rates to drop before buying?

While potential rate cuts in 2026 could improve affordability, waiting involves trade-offs. Current market conditions offer more time for evaluation and slightly better negotiating positions than summer. If rates drop significantly, competition could intensify again. The decision should be based on your personal circumstances, timeline, and whether you've found the right property at a price that works for your budget.

Is the market cooling or crashing?

The market is normalizing, not crashing. The transition from $420.3 million in July sales to $295.8 million in October represents typical seasonal patterns, not a fundamental collapse. Prices remain stable at $612,443 (up 12% from January 2024), sold-to-ask ratios stay near 99%, and seller's market conditions persist. The market is simply transitioning from overheated to sustainable, which is healthy for long-term stability.

Which property type offers the best investment opportunity?

This depends on your investment goals and budget:

- Condo apartments delivered the highest ROI at 32.8% year-over-year but may face correction risk

- Townhouses offer balanced returns (19.2% ROI) with strong rental fundamentals

- Semi-detached homes provide value (16.4% ROI) with single-family characteristics at accessible prices ($509,952)

- Detached homes offer stability (11.2% ROI) for premium market investors

Why have condo prices increased so dramatically?

Condo apartments surged 32.8% year-over-year due to several factors: severe supply constraints with limited new construction, strong demand from first-time buyers priced out of other segments, demographic shifts favoring urban living, and investors seeking rental income. The October average of $515,527 represents a new high, indicating sustained demand despite rapid appreciation.

Are townhouses worth the premium over condos?

With townhouses averaging $599,566 versus condos at $515,527, the $84,000 premium buys significant advantages: no condo fees, more space and privacy, outdoor areas, potentially higher appreciation (19.2% vs. 32.8% suggests condos may moderate), and broader resale appeal. For families and those seeking more space, townhouses often justify the premium despite higher entry costs.

Should I buy a semi-detached or save for a detached home?

Semi-detached homes ($509,952) offer compelling value versus detached homes ($669,818)—a $160,000 difference. Semi-detached properties delivered 16.4% ROI versus 11.2% for detached homes, suggesting better value appreciation. Unless you specifically need the privacy and space of a detached home, semi-detached properties provide excellent single-family characteristics at significantly lower cost and with stronger recent appreciation.

Conclusion

The Halifax-Dartmouth real estate market in October 2025 presents a story of resilience, transition, and remarkable segmentation by property type. With an overall average home price of $612,443 maintaining stability and a 98.5% sold-to-ask ratio demonstrating continued seller strength, the fundamentals remain solid. However, subtle shifts are emerging that signal market evolution and important distinctions across property categories.

Property Type Performance: October 2025 revealed extraordinary variation in appreciation across segments, with condo apartments leading at 32.8% year-over-year ROI, followed by townhouses (19.2%), semi-detached homes (16.4%), and detached homes (11.2%). These dramatic differences reflect underlying supply-demand dynamics, with the most "affordable" segments experiencing the strongest price pressure as buyers concentrate in accessible entry points.

The increase in average days on market to 43.8 days, combined with the moderation of sold-to-ask ratios from summer peaks above 100%, indicates that buyers are gaining marginally more leverage and taking additional time for due diligence. While technical seller's market conditions persist with an 80.5% sales-to-new-listings ratio, the market is transitioning from the frenetic pace of summer toward a more balanced environment.

For Buyers: October 2025 offers improved conditions compared to the highly competitive summer months. With more time to evaluate properties and slightly better negotiating positions, prepared buyers with pre-approvals and clear criteria can navigate the market more strategically.

Property type selection has become increasingly important: first-time buyers should carefully weigh condo apartments ($515,527) versus semi-detached homes ($509,952)—remarkably similar pricing but vastly different living experiences and investment profiles. The 32.8% year-over-year condo appreciation, while impressive, raises questions about sustainability, while semi-detached homes' 16.4% ROI may offer better long-term value. Townhouses at $599,566 represent an excellent middle ground for those who can stretch budgets, while detached homes at $669,818 remain largely the domain of move-up buyers with substantial equity.

Buyers should focus on properties priced appropriately for their segment, recognizing that overall market averages mask significant variation by property type. Working with agents who understand these segment-specific dynamics will be crucial for success.

For Sellers: The market remains favorable, with limited inventory supporting prices and strong demand across most segments. However, realistic pricing has become increasingly important as properties spend longer on market. Sellers who price competitively, present properties professionally, and maintain flexibility with showings will achieve the best results. The seasonal slowdown suggests sellers should carefully consider timing—listing now versus waiting for the spring 2026 market.

For Investors: Halifax-Dartmouth continues to offer compelling opportunities, though careful property type selection is paramount. Condo apartments delivered extraordinary 32.8% returns but come with correction risk as supply eventually responds to price signals. Townhouses (19.2% ROI) and semi-detached homes (16.4% ROI) offer more balanced risk-return profiles for most investors, while detached homes (11.2% ROI) provide stability for conservative, long-term strategies.

The rental market's strength—2.1% vacancy rate and average rents of $1,636—supports investment across all segments. The overall 12%+ year-over-year price appreciation since January 2024 demonstrates solid capital appreciation potential across the board, while the market's transition toward sustainability reduces the risk of overheating. Investors should carefully analyze cash flow, appreciation potential, and risk tolerance when selecting property types, recognizing that the gap between lowest ROI (11.2%) and highest ROI (32.8%) represents fundamentally different investment profiles.

Looking Ahead: The October data suggests Halifax's real estate market is maturing from rapid growth to more sustainable patterns. Total transaction values of $295.8 million, while below the summer peak of $420.3 million, remain notably above early 2024 levels, indicating sustained underlying demand. The combination of strong economic fundamentals (3.9% GDP growth, declining unemployment), infrastructure investments (Barrington Street Transit Terminal, Housing Accelerator Fund), and continued population growth positions the market for steady appreciation.

Government initiatives supporting housing supply, including the Housing Accelerator Fund targeting 2,600 new homes by 2026 and zoning reforms to expedite development, should gradually improve inventory levels and moderate price growth. Potential interest rate cuts in 2026 could stimulate renewed buyer activity, though affordability challenges will persist for many households.

The Halifax-Dartmouth real estate market in October 2025 ultimately reflects a healthy transition: from overheated growth to sustainable appreciation, from extreme urgency to measured decision-making, and from severe supply constraints to gradually improving inventory. Whether buying, selling, or investing, success in this market requires understanding these nuanced dynamics and working with experienced professionals who can navigate the shifting landscape.

For the most current market data and personalized guidance, consult with local real estate professionals who can provide neighborhood-specific insights and strategic advice tailored to your unique circumstances and goals.

Curious about the October 2025 Market Stats for Truro? Please click here

Curious about the October 2025 Market Stats for the South Shore? Please click here

Curious about the October 2025 Market Stats for Cape Breton? Please click here

Curious about the October 2025 Market Stats for the Annapolis Valley? Please click here

Data Sources: Halifax Partnership Economic Dashboard, Halifax-Dartmouth Regional Market Visualizations (October 2025), Nova Scotia Association of Realtors, Canadian Real Estate Association, RE/MAX Market Reports, and local real estate boards.

Disclaimer: This article provides general market information and should not be considered financial or investment advice. Real estate markets can vary significantly by neighborhood and property type. Consult with licensed real estate professionals, mortgage brokers, and financial advisors before making real estate decisions. All statistics are subject to revision and represent snapshot data from October 2025.

Last Updated: November 2025 Market Report Period: October 2025 Coverage Area: Halifax-Dartmouth Regional Municipality, Nova Scotia Data Visualization Source: Halifax-Dartmouth Real Estate Market October 2025 Charts